Buyer Tax

In the auction industry, a buyer tax refers to the sales tax or any applicable local taxes that are added to the final purchase price of an item. This tax is collected from the buyer at the time of payment and is typically calculated as a percentage of the winning bid amount. The auction house or platform is responsible for collecting this tax and then remitting it to the appropriate tax authorities.

Buyer taxes can vary depending on the location of the auction and the type of items being sold. Some auctions may also be exempt from sales tax under certain conditions, such as for items being shipped out of state or for tax-exempt buyers.

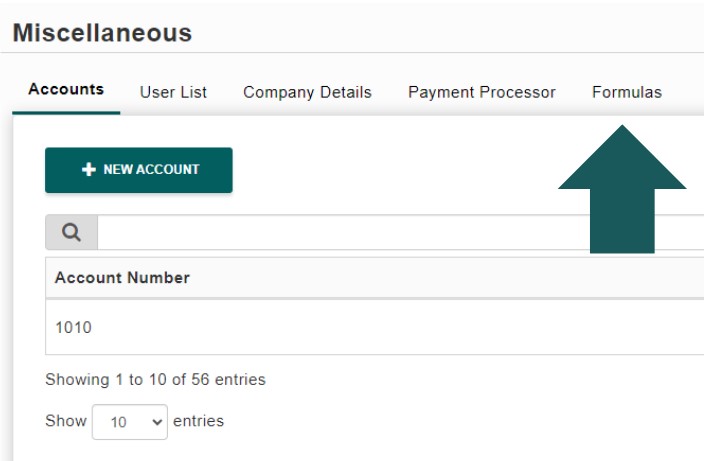

- To create your tax formulas, go to the Miscellaneous section at the top of the page, then click the Formulas button.

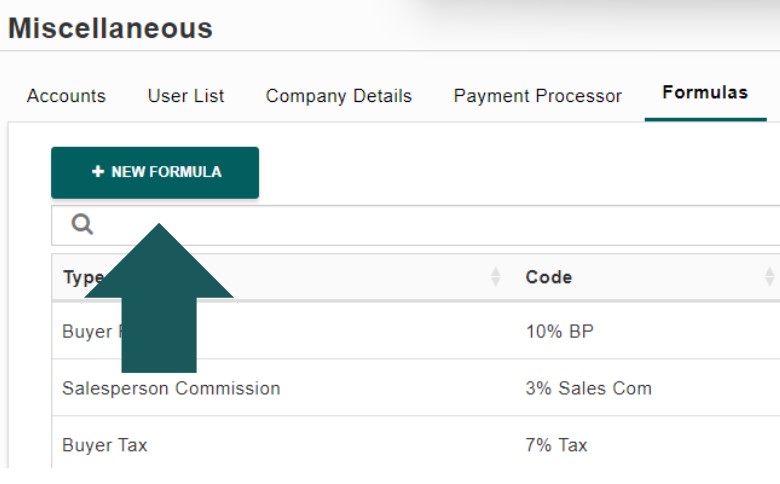

- Click the “New Formula” button to create a new formula.

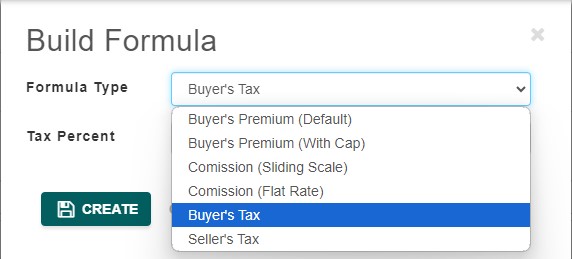

- Choose “Buyer’s Tax” as the formula type.

- Next, enter the tax percentage you want to charge your bidders. When you’re finished, click the “Create” button.

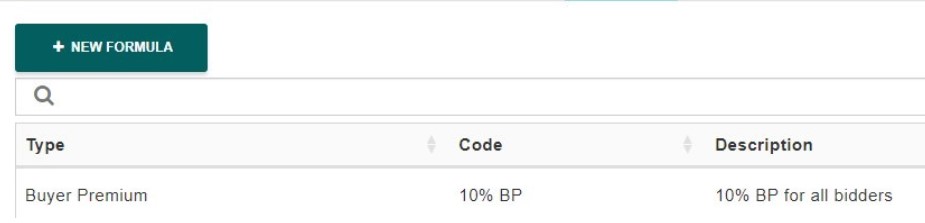

- After you’ve finished, the buyer’s tax will appear in the list of created formulas. You can edit the formula if needed, or create multiple buyer’s premium formulas for a selection to choose from. This applies to all formula types.

Applying the Formula

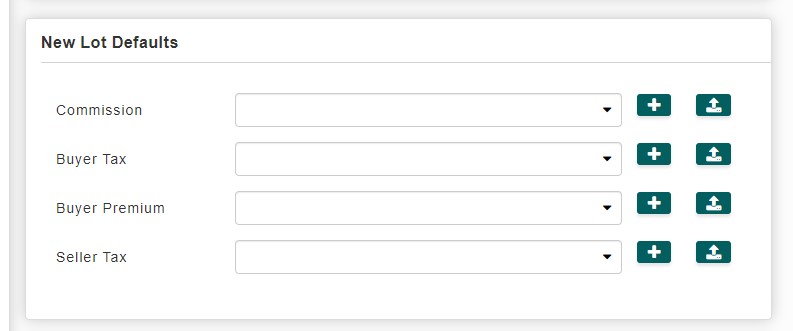

You can apply the formula in the Pre-Auction section of AF360 under ‘Details’ and ‘New Lot Defaults.’ Simply select the desired formula, and it will automatically be applied to all future items added to the sale. If you’ve already added items before the formula was created, you can use the upload button on the right to update existing lots with the new formula.

Buyer Tax: This dropdown allows you to set a default tax formula that will apply to the buyer’s purchase. The buyer tax is added to the buyer’s total purchase price and is not related to the seller’s proceeds. This ensures the correct tax is collected from the buyer based on the formula selected.

Plus Sign (+): Clicking this button allows you to add a new formula for each corresponding field (e.g., commission, buyer tax, buyer premium, or seller tax). You can customize rates or percentages to match specific auction needs.

Upload Icon: The upload button allows you to apply the selected formula to all existing lots, ensuring consistency across the auction.

This screen helps standardize the application of fees, taxes, and commissions across all new lots, making the setup process more efficient for each auction.