Create Taxes

In the auction industry, a buyer tax refers to the sales tax or any applicable local taxes that are added to the final purchase price of an item. This tax is collected from the buyer at the time of payment and is typically calculated as a percentage of the winning bid amount. The auction house or platform is responsible for collecting this tax and then remitting it to the appropriate tax authorities.

Buyer taxes can vary depending on the location of the auction and the type of items being sold. Some auctions may also be exempt from sales tax under certain conditions, such as for items being shipped out of state or for tax-exempt buyers.

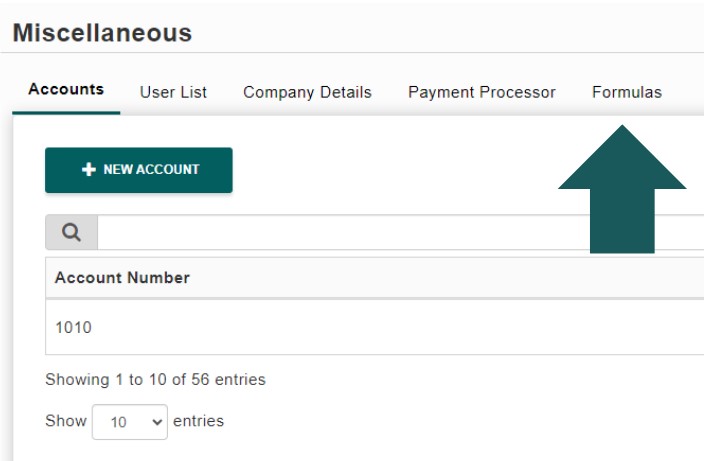

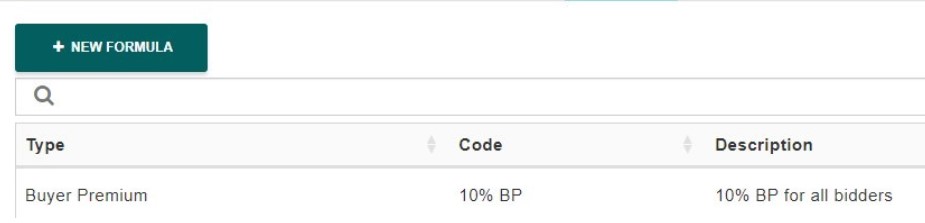

- To create your tax formulas, go to the Miscellaneous section at the top of the page, then click the Formulas button.

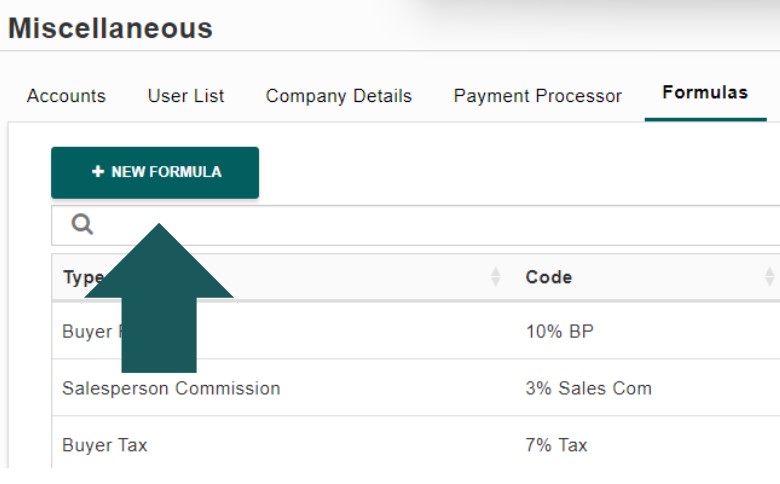

- Click the “New Formula” button to create a new formula.

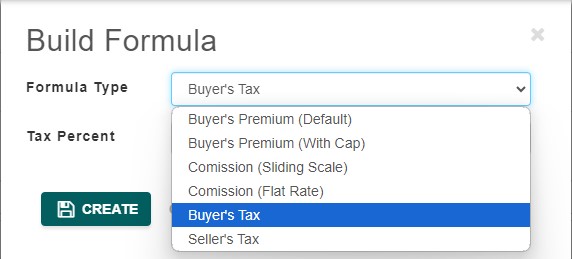

- Choose “Buyer’s Tax” as the formula type.

- Next, enter the tax percentage you want to charge your bidders. When you’re finished, click the “Create” button.

- After you’ve finished, the buyer’s premium will appear in the list of created formulas. You can edit the formula if needed, or create multiple buyer’s premium formulas for a selection to choose from. This applies to all formula types.

How to Apply Taxes to an Auction

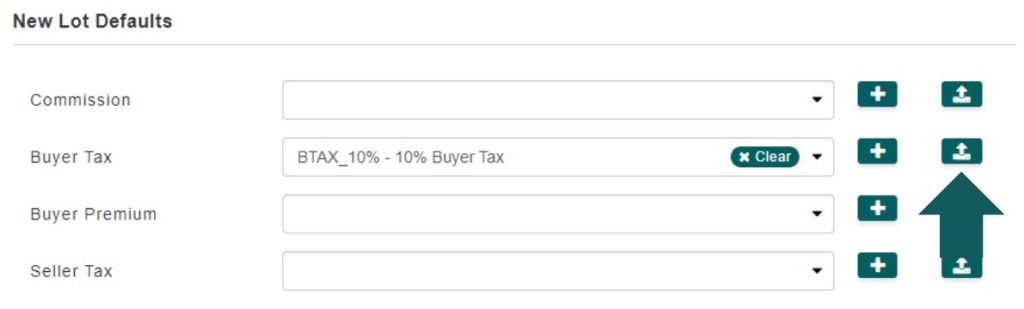

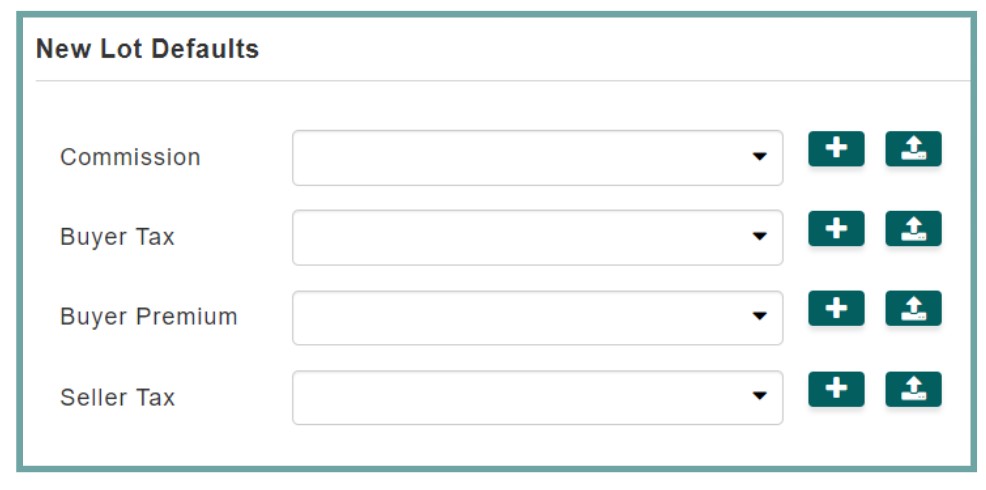

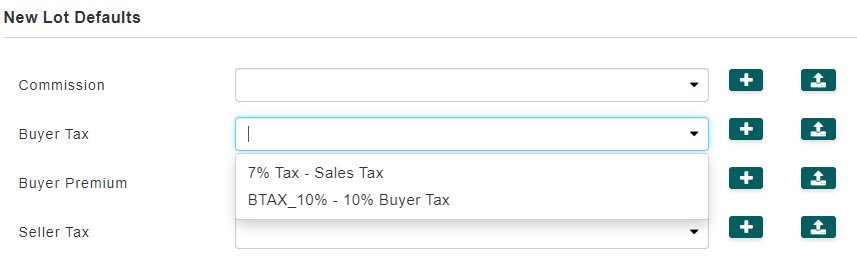

The ‘New Lot Defaults’ section, found under Pre Auction, applies essential charges—commission, buyer tax, buyer premium, and optional seller tax—to lots in AF360.

- Click the plus sign button to view the Buyer’s Tax formulas you’ve created, then choose the one you’d like to apply to the auction.

- If you have added lots to your auction before setting your formulas, ensure you click the upload button on the right to update your lots with the new formulas.